The Fair Labor Standards Act Overtime Calculator Advisor provides employers and employees with the information they need to understand Federal overtime requirements. The regular rate is calculated by dividing the total pay for employment in any workweek by the total number of hours actually worked to determine the regular rate. To properly compute overtime on a flat sum bonus, the bonus must be divided by the maximum legal regular hours worked in the bonus-earning period, not by the total hours worked in the bonus-earning period. This calculation will produce the regular rate of pay on the flat sum bonus earnings.

Overtime on a flat sum bonus must then be paid at 1.5 times or 2 times this regular rate calculation for any overtime hour worked in the bonus-earning period. Overtime on production bonuses, bonuses designed as an incentive for increased production for each hour worked are computed differently from flat sum bonuses. To compute overtime on a production bonus, the production bonus is divided by the total hours worked in the bonus earning period. This calculation will produce the regular rate of pay on the production bonus. Overtime on the production bonus is then paid at .5 times or 1 times the regular rate for all overtime hours worked in the bonus-earning period. Overtime on either type of bonus may be due on either a daily or weekly basis and must be paid in the pay period following the end of the bonus-earning period.

I paid my employee for 43 hours of wages during the last workweek. Eight of those hours were paid as sick leave, as the employee was out ill for one day. Am I required to pay the employee for three hours of overtime? The required overtime pay is 1.5 times the hourly rate for hours worked in excess of 40 in a workweek. Overtime is calculated based on hours actually worked, and your employee worked only 35 hours during the workweek.

Unless a policy, contract or collective bargaining agreement states otherwise, you needn´t count sick leave, vacation time, holidays, or other paid time during which the employee did not actually work. My employer paid me for 43 hours of wages during the last workweek. Eight of those hours were paid as sick leave, as I was out ill for one day.

Overtime is calculated based on hours actually worked, and in this scenario you worked only 35 hours during the workweek. Unless a policy, contract or collective bargaining agreement states otherwise, you do not get overtime pay if you used sick leave, vacation time, holidays, or other paid time and did not actually work. While salary and wages are important, not all financial benefits from employment come in the form of a paycheck. The Fair Labor Standards Act, passed in 1938, guarantees employees compensation at one and a half times their regular rate for hours worked above 40 hours per week. How overtime is calculated depends on whether the employee is paid hourly or by salary. Further, the calculation for salaried employees differs depending on the number of hours per week the salary is meant to compensate for.

Salary to hourly wage calculator lets you see how much you earn over different periods. It is a flexible tool that allows you to convert your annual remuneration to an hourly paycheck, recalculate monthly wage to hourly rate, weekly rate to a yearly wage, etc. This salary converter does it all very quickly and easily, saving you time and effort. In the article below, you can find information about salary ranges, a closer look at hourly and annual types of employment, as well as the pros and cons for each of these.

Moreover, you can find a step-by-step explanation of how to use this paycheck calculator down below. Is there a maximum number of hours employees can work during a day? For most adult workers, there are no limits on daily work hours. Theoretically, employers may schedule employees to work seven days a week, 24 hours per day, so long as minimum wage and overtime laws are observed.

Manufacturing employees are limited to 13 hours of work in a 24-hour period. There are also daily and weekly limitations on the hours minors can work. For more information, see the Oregon Wage & Hour Laws handbook. The agreed upon regular hours must be used if they areless thanthe legal maximum regular hours.

For example, if you work 32 to 38 hours each week, there is an agreed average workweek of 35 hours, and thirty-five hours is the figure used to determine the regular rate of pay. If you work more than 35 but fewer than 40 hours in a workweek, you will be entitled to be paid for the extra hours at your regular rate of pay unless you work over eight hours in a workday or 40 hours in a workweek. If you are paid on an hourly or daily basis, the annual salary calculation does not apply to you. Your bi-weekly pay is calculated by multiplying your daily or hourly rate times the number of days or hours you are paid. Overtime wages must be paid no later than the payday for the next regular payroll period after which the overtime wages were earned. Yes, there are certain types of payments that are excluded from the regular rate of pay.

Were you offered a new job opportunity and want to derive the prospective hourly wage from the offered annual salary? Just like in the last example, you need to know exactly how many hours you'll have to work per week at your new job. If you don't, the average full-time employee works 40-hours per week , and we can use that as a baseline for our calculations.

To determine your hourly wage, divide your annual salary by 2,080. The Fair Labor Standards Act requires that overtime must be paid at a rate of 11/2 times a covered employee's regular rate of pay for each hour worked in excess of 40 hours in a workweek . The FLSA does not require that overtime be paid to employees who are exempt or for hours worked in excess of 8 hours per day or on weekends or holidays. The hourly to salary calculator converts an hourly wage to annual salary — or the other way around. As an employer, use this calculator to help determine the annual cost of raising an hourly rate, or how hourly workers' overhead business expenses on an annual basis. A group rate for piece workers is an acceptable method for computing the regular rate of pay.

In using this method, the total number of pieces produced by the group is divided by the number of people in the group, with each person being paid accordingly. The regular rate for each worker is determined by dividing the pay received by the number of hours worked. For example, Sarah works as a Tax Preparer with an hourly rate of $27 and works 35 hours per week. We take her hourly rate of $27 and multiply it by her weekly hours of 35, which gives us $945. Then, we'll multiply $945 by 52 to get the annual salary of $49,140.

We'll then divide $49,140 by 12, which gives us a $4095 gross monthly income. An employer that banks overtime hours and subsequently pays for those hours must use the employee's regular rate of pay at the time the overtime is calculated. Regular rate of pay includes any special payments such as longevity, hazardous duty pay, benefit replacement pay, qualified bonus payments and other special payments.

Freelancers' earnings are usually based on hourly or daily rates though, sometimes, they are based on weekly or monthly payments. And since working as a freelancer doesn't come with the many benefits that full-time employees enjoy, their pay must be higher than what full-time employees would relatively earn. In our contemporary supply-demand-driven environment, however, we often see that the rates are under pressure. In the U.S., salaried employees are also often known as exempt employees, according to the Fair Labor Standards Act .

This means that they are exempt from minimum wage, overtime regulations, and certain rights and protections that are normally only granted to non-exempt employees. To be considered exempt in the U.S., employees must make at least $684 per week (or $35,568 annually), receive a salary, and perform job responsibilities as defined by the FLSA. Certain jobs are specifically excluded from FLSA regulations, including many agricultural workers and truck drivers, but the majority of workers will be classified as either exempt or non-exempt. It's imperative that you review the Fair Labor Standards Act whenever you convert an hourly employee to salaried pay. There are federal laws that govern the classification of salaried employees. When an employee is employed on a piece-rate basis, his or her regular hourly rate of pay is computed by adding together his or her total earnings for the workweek and dividing by the number of hours worked in the week.

For overtime work, the pieceworker is entitled to extra half-time pay at this rate for all hours worked in excess of 40 in the workweek. The employee is then entitled to extra half-time pay at this rate for all hours worked in excess of 40 in the workweek. This salary calculator estimates total gross income, which is income before any deductions such as taxes, workers compensation, or other government and employer deductions. To determine your net income, you have to deduct these items from your gross annual salary. Note that deductions can vary widely by country, state, and employer. When you convert hourly to salary, it's important to consider deductions as well.

Take, for example, a salaried employee who is paid $500 in salary for a 50-hour workweek and works a 50-hour week. The first step, as before, is to calculate the Regular Rate. However, the Overtime Hours—the hours between 40 and 50—have already been compensated by the salary. In effect, the employee has been paid $10/hour for those Overtime Hours. Thus, in calculating the overtime pay cannot be calculated by multiplying the Regular Rate by 1.5 because the employee has already received part of what he is entitled to.

Even though the fixed salary is not based on the number of hours worked, you still use the number of hours worked each week to determine the overtime rate. Since the salary is intended to compensate the employee at straight-time rates for whatever hours are worked in the workweek, the employee's regular rate will vary from week to week. Using this method, the more hours an employee works beyond 40 in a workweek, the less overtime compensation he or she receives. Can my employer offer me "comp" time off instead of paying overtime? Only government agencies are permitted to offer compensatory time in lieu of overtime.

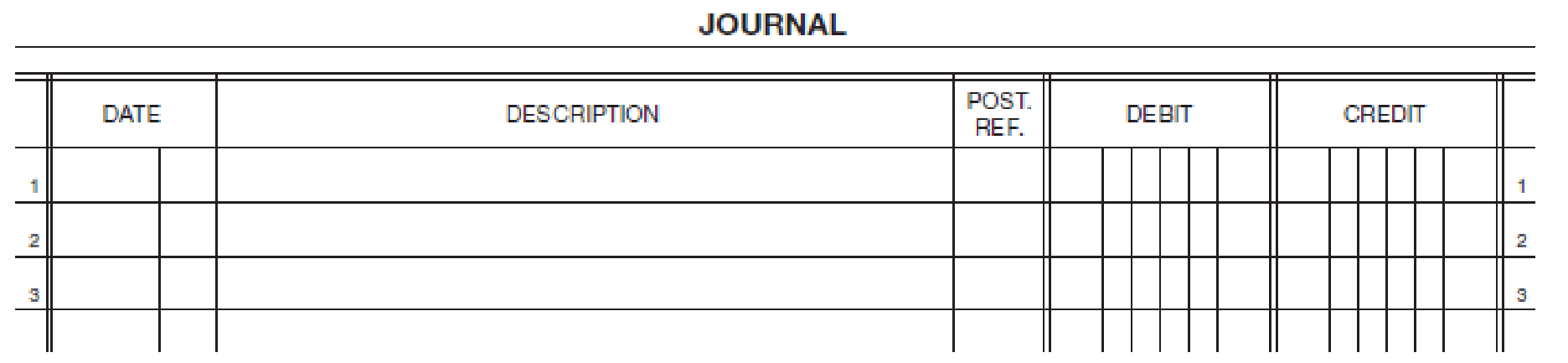

If you are a private sector employee, you must received overtime pay when you work over 40 hours in a workweek. Your employer can discipline you for violating its policy by working overtime without the required authorization. However, wage and hour laws require that you are compensated for hours you work. OT Overtime The Time Card summary shows regular work hours and overtime hours.

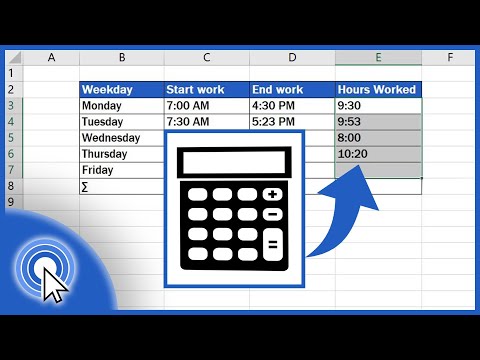

As a simple baseline calculation, let's say you take 2 weeks off each year as unpaid vacation time. Then you would be working 50 weeks of the year, and if you work a typical 40 hours a week, you have a total of 2,000 hours of work each year. In this case, you can quickly compute the hourly wage by dividing the annual salary by 2000. Your yearly salary of $72,000 is then equivalent to an average hourly wage of$36 per hour. Use our calculator and enter your hourly wages in the Current Salary and set the Pay Period to hourly.

Then, input the number of hours you work in the Weekly Hours field. Once you figured out your weekly amount, multiply the total by 52 to get the gross yearly income. Then, divide the number by 12 to get your gross monthly income. Even when paying piece rate, an employer must always track the number of hours their employees work. Once an employee works over 40 hours in a single week, they must be awarded overtime pay.

Always be aware of the overtime regulations in your area when calculating your payroll - some regions, such as California in the United States, have their own requirements for minimum wage and overtime. Stating the employee wage in an hourly pay rate form helps the employer remain compliant with the FLSA and state wage and hour rules and avoids wage disputes with the employee. In a formal dispute (Wage & Hours Board Complaint), a work agreement that simply stipulates a weekly salary will be evaluated based on a 40 hour work week.

Our exclusive Hourly Pay Rate Calculator simplifies the conversion of a periodic salary to an hourly wage. If you know the reasonable hourly rate for your employee, it's simple to calculate an annual salary. This type of calculation is especially helpful when you are converting an hourly wage earner to a salaried position. It's also helpful when you are considering transitioning an independent contractor – typically paid by the hour – to a salaried position with your company. Department of Labor's regulations prevents an employer from paying an employee at or above the minimum wage or at a higher overtime rate of pay.

In addition, a number of states have enacted minimum wage and overtime pay laws, some of which provide greater worker protections than those provided by the FLSA. In situations in which an employee is covered by both Federal and state wage laws, the employee is entitled to the greater benefit or more generous rights provided under the different parts of each law. More information about state laws may be found through the state labor offices. "Nonexempt" means that the covered employee is entitled to the law's minimum wage and/or overtime requirements.

FLSA overtime pay is due on the regular pay day for the period in which the overtime was worked. The overtime pay requirement may not be waived by agreement between the employer and the employee. The overtime pay requirement cannot be met through the use of compensatory time off except under special circumstances applicable only to state and local government employees. In the U.S., according to the payment rules regulated by the Fair Labour Standards, salary workers are not covered by overtime . It is worth mentioning, that in many countries companies offer their workers various kind of compensations for overtime hours. That might be just additional money, time off adequate to the number of overtime hours, or other benefits.

When a salaried employee is classified as non-exempt under Fair Labour Standards, an employer has to pay one and a half for each extra hour over standard 40 per week. To avoid misunderstandings, clear all your doubts in your state's Department of Labour or your country's labour law. • Input your hourly wage, normal hours per week, overtime hours, and no. of weeks worked in a year to determine weekly and annual salary. The other option is to pay a non-exempt employee a Fixed Salary for a Fluctuating Workweek . The FSFW method is a useful option when an employee's hours change from week-to-week. If you wanted to be even more accurate, you can count the exact number of working days this year.

40 Hours Work Week Calculator It has a total of 365 days in the year including both weekdays and weekends. So if you worked a normal 8 hour day on every weekday, and didn't work any overtime on the weekends, you would have worked a total of 2,080 hours over the 2022 year. You can then convert your annual salary to an hourly wage of roughly$34.62 per hour. Ordinarily, the hours to be used in computing the regular rate of pay may not exceed the legal maximum regular hours which, in most cases, is 8 hours per workday, 40 hours per workweek.

This maximum may also be affected by the number of days one works in a workweek. It is important to determine what maximum is legal in each case. Overtime is based on the regular rate of pay, which is the compensation you normally earn for the work you perform.

The regular rate of pay includes a number of different kinds of remuneration, such as hourly earnings, salary, piecework earnings, and commissions. In no case may the regular rate of pay be less than the applicable minimum wage. To calculate your annual salary from your biweekly income, you must first multiply your biweekly wage by the number of weeks you work. If you don't have any weeks off at the end of the year, you'll generally multiply your wages by 26.

There are 52 weeks in a year, so you'll divide this by 2 to get your biweekly pay periods. So, for example, if you do have two unpaid weeks, take one biweekly pay period off from the resulting number. If you'd like to figure out how how to turn your hourly wage into the annual salary equivalent, you first need to pen out many hours you work per week. In our calculator, you can insert your Current Salary, set the Pay Period to Annual, and throw in the total hours in the Weekly Hours section. However, make sure you only add the hours you've been on the clock without including unnecessary breaks or off-the-clock time.